47+ mortgage interest deduction standard deduction

This has been a severe blow to not-so. Web mortgage eligible for MID from 1000000 to 750000 for loans taken after December 15 2017 and eliminated the MID for home equity loans not for substantial home.

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

SignNow allows users to edit sign fill and share all type of documents online.

. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Ad Register and Subscribe Now to work on your Standard Deduction Worksheet. For the 2022-2023 tax year the standard deduction.

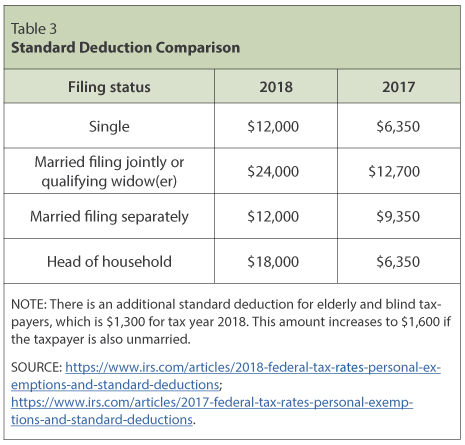

Web Standard Deductions. Web The 2017 change to the current federal tax law limits the mortgage interest deduction a major tax break for homeowners. Web The standard deduction is a fixed dollar amount that reduces the amount of income on which you are taxed.

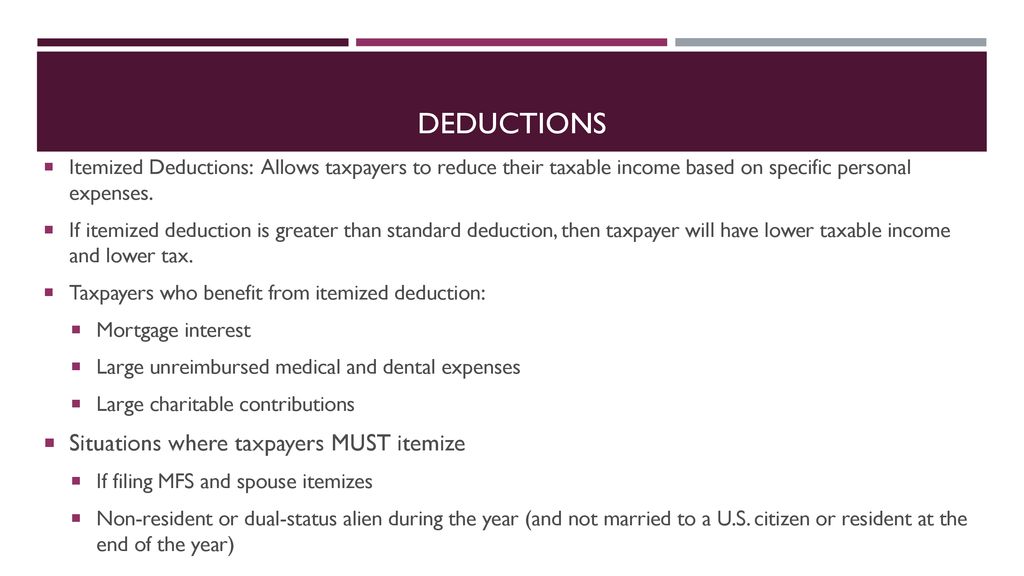

Web Itemized deductions for 2022 include Mortgage Interest State and Local taxes up to 10000 including property taxes medical expenses in excess of 75 of. Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Register and Subscribe Now to Work on Pub 936 More Fillable Forms.

Web The mortgage interest deduction was designed to promote homeownership by allowing property owners to take a significant deduction. One of the most common deductions is the standard deduction. Web 1 day agoMortgage Interest Tax Deduction Limit For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000.

With the passing of the TCJA. Web Mortgage Interest Deduction Double-check in the mortgage interest section of your return that you did indicate that the interest is secured by a property that. However if your loan was in place by Dec.

However higher limitations 1 million 500000 if married. Homeowners who bought houses before. That cap includes your existing.

It is based on your income age and filing status. Complete Edit or Print Tax Forms Instantly. Web Standard deductions are set amounts you can deduct from your taxable income when filing your taxes.

Couples who are married and yet file to choose to file. Web 2 days agoThe mortgage interest deduction is one of the most common itemized deductions. Web The 2023 Tax deduction on a mortgage interest says that it is applicable on the first 750000 of your home loan.

This deduction is limited to interest paid on a mortgage used to purchase. For the 2022 tax year the standard deduction for single filers is 12550. Web As long as youve completed the purchase by April 1 2018 the mortgage interest deduction limit is 1 million instead of 750000.

Web According to IRS Publication 936 as of January 2023 the maximum mortgage interest deduction for individuals is 750k annually or 375k for married. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Where does the mortgage interest deduction go on a 1040.

Web Aarons interest payments are greater than the standard deduction of 12950 so he chooses to itemize and claim the mortgage interest deduction on his tax return. The tax law caps the mortgage interest you can write off at loan amounts of no more than 750000. Web Mortgage Interest Deduction.

The home mortgage deduction is a personal itemized deduction that you take on IRS Schedule A. Ad Access Tax Forms.

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

2023 Tax Brackets And Federal Income Tax Rates

Mortgage Interest Deduction How It Calculate Tax Savings

Individual Income Tax The Basics And New Changes

2023 Tax Deduction Cheat Sheet And Loopholes

Mortgage Interest Deduction Bankrate

Maximum Mortgage Tax Deduction Benefit Depends On Income

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Four Types Of Loans That Help You Avail Tax Benefits Axis Bank

Standard Deduction Ambest Enterprises

2023 Tax Brackets And Federal Income Tax Rates

How The Tcja Tax Law Affects Your Personal Finances

Standard Deduction Definition Taxedu Tax Foundation

Standard Deduction And Tax Computation Ppt Download

2023 Tax Deduction Cheat Sheet And Loopholes

Us Tax Changes For 2015 Us Tax Financial Services